Joining a new company entails an adjustment period whether you’re fresh out of college or an old pro. There are new processes, new people, and new internal dynamics to understand. The onboarding process goes through three phases at every new career stop:

- Orientation – That every organization calls it “orientation” is a tacit recognition that starting a new job is disorienting. After you go through the basic new hire onboarding and meet your new team, this phase consists mainly of reading lots of internal documents and sitting in meetings to learn exactly what it is you need to do. This usually lasts two or three weeks, and the goal of this phase is to get to a solid understanding of what your job really is.

- Acceleration – As basic orientation winds down, you start to become integrated into the company’s machinery. The number of recurring meetings start to ratchet up as you learn which people you need to work with and on what. In the acceleration phase, you make your first decisions without 100% of the context you’d like, but you have no choice but to start taking some swings. This somewhat uncomfortable phase lasts up to several months.

- Acclimation – At this point, you know the lay of the land. You have a better understanding of not only the decisions that have been made, but why they’ve been made. You have a solid mental model of your industry and you’ve uncovered for yourself the big challenges facing the organization. This phase only ends when you leave for a new company and start again at the orientation phase.

I say that the acclimation phase never ends only partly tongue-in-cheek. The point is that once you’re sufficiently confident in your knowledge to think strategically about the business and the industry you compete within, that part never stops. And thank God, because this is when big-picture thinking starts to become really fun. At this stage, you’re no longer constantly running into gaps in your knowledge that slow you down or cause you to make mistakes. You can focus on adding value for the business without being completely consumed by just getting tasks done. Not only are you able to take on more important projects, you know which levers to pull within the organization to drive things to completion.

The only downside to the acclimation stage is that it takes most people a long time to reach it. For people who have just started their careers, it often takes years for them to build up their institutional knowledge enough to propose big ideas. Remember though, your job is to find ways to add value to the business from day one. Career advancement depends on getting to the acclimation stage as fast as possible. How quickly you get there depends on the depth of understanding you can achieve on your own, and the guidance you get from experienced colleagues.

Speed Up Your Learning Curve by Creating a Position Map

There is a simple but effective process I like to use to quickly speed up the learning curve in a new company. It’s called a “positioning map”, and it is a means of plotting your company visually against its competitors based on the strategies that each are pursuing. The graphic is simple; the effort lies in distilling your competitors’ strategies well enough to group them along strategic dimensions. I like the positioning map is that it forces you to think big picture, but you don’t need to know everything about the business yet. You can create a positioning map even if you wouldn’t feel confident writing a strategic plan for the business. All you need is an understanding of your company and its place in the industry today. You can also create a positioning map for your division in a large business or even a single product line if that’s more appropriate for your situation.

To get value out of creating the positioning map, you need think deeply and do your homework without striving for absolute perfection. On other words, don’t settle for elevator pitch statements of your company’s strategy, but don’t boil the ocean either. Read what industry analysts say about your company as well as its competitors. If you work for a public company, it will be easy to find reports on your company. If your company is privately held you may have to look a little harder to find good information, but it’s out there. Read reviews of your company compared to competitors. Look on glassdoor to see what employees say about your company and your competitors. If customers review your products online, read what they’re saying. Compare what you see published by outside sources with what the company’s strategy seems to be from an insider’s perspective. Use the hidden sources of information in your company to create a really robust understanding of how the business operates. Spot the gaps and make assumptions where you need to in order to create a new point of view.

Once you feel like you’ve got a decent understanding of your own company’s strategy, you need the same for your competitors. Things get a little tougher here, because you don’t have any insider information. Think of every possible source you can (legally and ethically) get your hands on and look for patterns among your competitors. Read your competitors’ press releases and marketing materials to learn more about their products, partnerships, and how they present themselves to the market. What do they claim to be the best at? Do this for enough companies, you’ll find that you can bucket them into a few types that appear to be doing similar things with similar capabilities. You don’t need to propose any new strategy here – you’re just trying to document the world as-is.

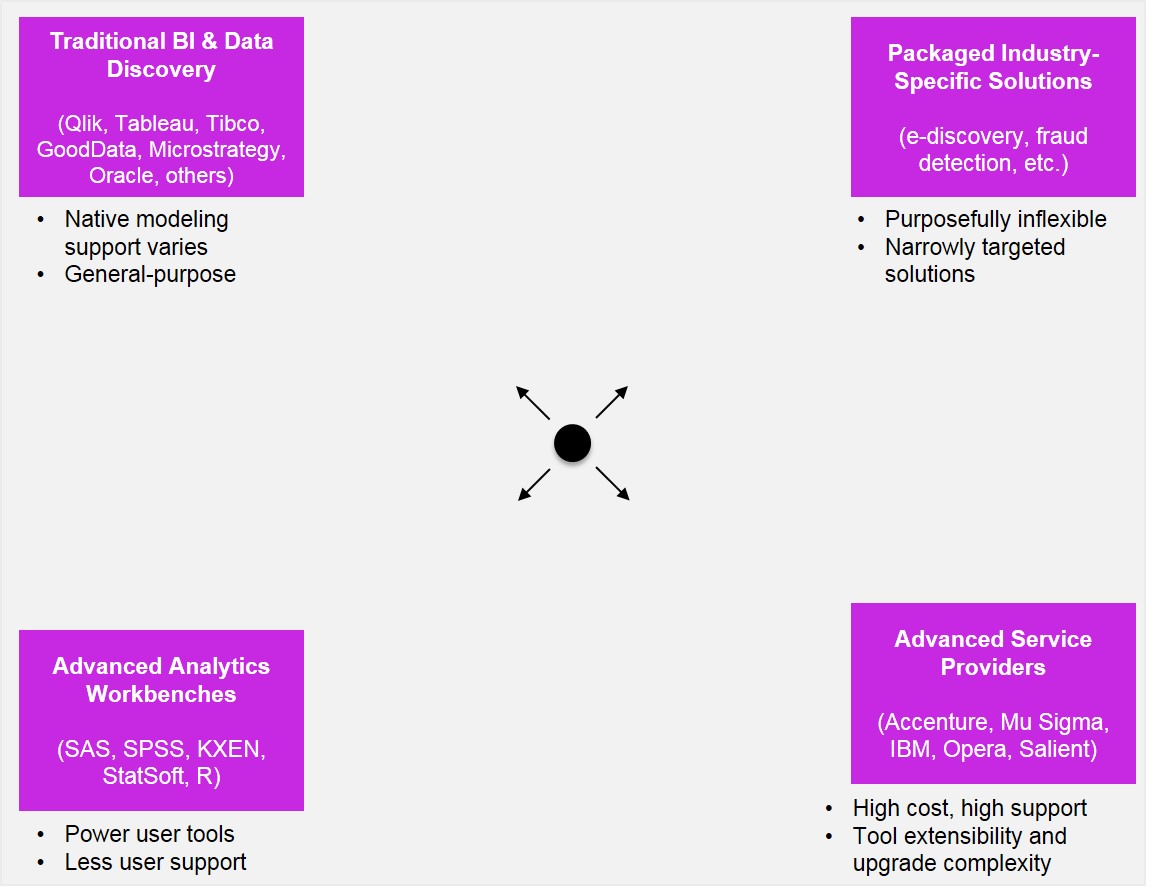

As an example, below is a simplified positioning map for the analytics software and services industry (something close to my heart) to show you how to get started. Once you’ve mapped out the positions of your competitors, figure out where your company fits on the graph. That graph has as many nodes as there are strategies that companies follow. Note that the geometry is only directionally important for placing your company strategically (i.e. nothing is to scale, and the spacing is used only to figure out near which node your company falls).

The graphic shows a simplified impression of the high-level categories of analytics software and service providers in the market. For most, I listed a few competitors by name whose products and services I’m familiar with. Depending on your industry, you may research many more. Also under each, I list some basic attributes. You’ll need a much more extensive catalog of competitor strengths and weaknesses when you create a real positioning map, but you get the idea. The point is to accumulate all the knowledge you can to get a mental model of your industry so when you see something new you can relate it back to a consistent framework.

Whether you work for a startup or centuries-old company, you should still go through the exercise of building a positioning map. Even in the most established industries, businesses must differentiate themselves from one another. My example positioning map in fact spans several markets. You could create a more granular positioning map within any one of the markets in the four corners of the graph and still find plenty of differentiation. Consulting firms differ in the types of services that they can bundle together, their areas of deep expertise, their external partnerships, and so on. Software companies differentiate their products on the basis of price, ease of use, feature richness, and technical support availability. Investment banks may differentiate themselves on the basis of expertise in certain markets, fees, post-IPO support – again, you get the idea. Find out what those vectors are in your industry and start teasing out the differences so that you can build a more solid mental map.

Parlay Your Mental Map into Feedback and Mentoring

Once you have the positioning map in a presentable state, test your understanding with people who are closer to strategy formation in your company than you are. Put it on a whiteboard or lay it out on a slide and get peoples’ thoughts. Odds are that you won’t have all the nuances right, so the goal is largely to find out what you’re missing. If you’ve come up with some interesting thoughts as your company’s place in the industry, that’s good enough to have the good discussion. Aside from forcing you to learn, one reason why creating your mental model like this is so valuable is that if you ask for a detailed explanation of the corporate strategy from a senior manager, you’re putting the burden on them. To save time, they may refer you to the generic marketing materials or internal presentations that ignore the real challenges the company faces. On the other hand, if you give them something new and interesting to react to, you’re inviting a deeper conversation about the business with someone who is in the know. People will feel compelled to correct any misperceptions and provide their own. This give-and-take becomes your launch point for seeking additional mentorship from this person in the future.

Diagramming out your mental map of the industry ultimately helps you evaluate tough, subjective questions about the business. It also forms the basis of your framework for making long-term decisions, because you’ll always be able to relate back to a rock-solid understanding of the competitive landscape and where you fit within it. Best of all, doing the exercise thoughtfully shows people that you are a serious thinker when it comes to the business. For me, going through the exercise was a big help to my career when I was twenty-six.

The only problem was that I should have done it when I was twenty-two.